Taxes & Incentives

To make your company’s move or expansion easier, a variety of local and state incentives may be available. You’ll also find many tax advantages in Rockwall.

Bottom Line Benefits

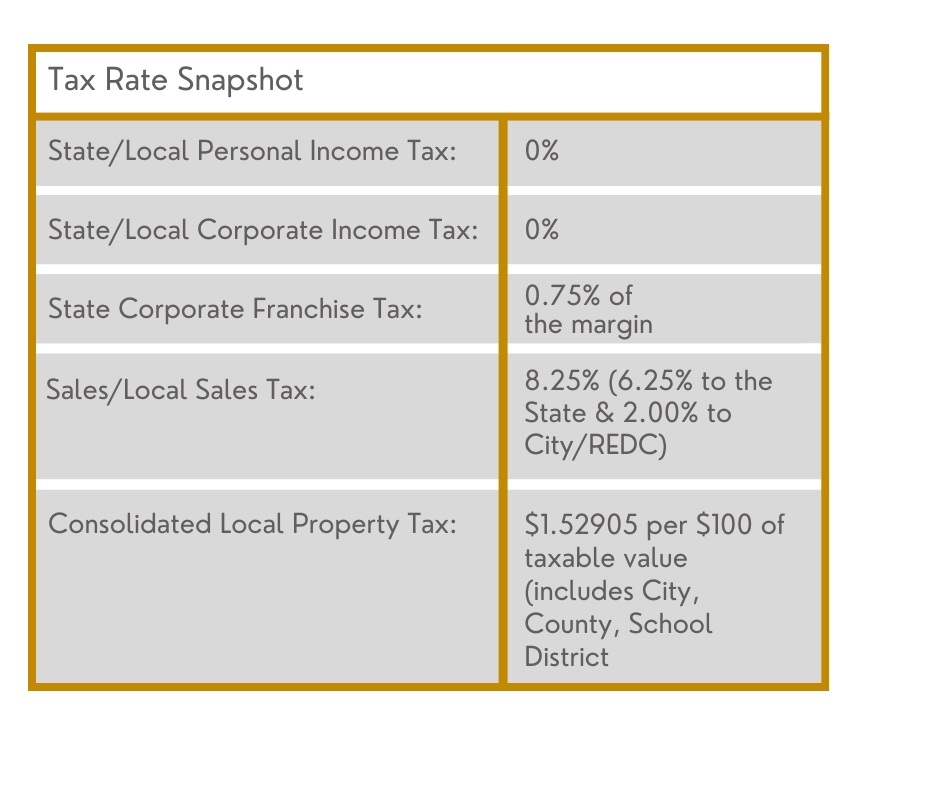

Along with Rockwall’s logistical and workforce benefits, costs are minimized and profits are enhanced as a result of our community’s favorable tax structure and robust incentive packages offered to qualified relocating or expanding companies. The following is an overview of the tax climate and incentive programs that may be available:

Tax Exemptions

Freeport: In Rockwall, certain types of inventory that is manufactured within the community, but transported out of the state within 175 days, is exempt from property tax from all local taxing jurisdictions. More information can be found here.

Machinery and Equipment: In Texas, machinery, equipment, parts and accessories that are used or consumed in manufacturing, processing, fabricating, or repairing property for sale are exempt from state and local sales and use tax. More information can be found here.

Natural Gas and Electricity: Texas companies are exempt from paying state and local sales and use tax on electricity and natural gas used in manufacturing, processing, or fabricating tangible personal property. The company must complete a “predominant use study” that shows 50% of the electricity or natural gas consumed consumed by the business directly causes a physical change to the product.

Local Incentives

Texas differs from most states in that economic development and incentive negotiations are primarily handled at the local level. While there are some aggressive incentives offered by the Governor’s Office, for most projects, the largest share of incentives originate locally. In Rockwall, these incentives are offered by the REDC. Incentive offers are subject to the discretion of the REDC Board, and will be considered based on economic factors such as investment planned and high-quality jobs created. Per state law, all companies agreeing to an incentive must enter into a performance agreement with the REDC.

The following local incentive application shall be filled out, and sent to info@rockwalledc.com for incentive consideration. Companies are encouraged to discuss potential projects with REDC staff before applying.

Direct Financial Incentives: The REDC can offer direct funding to defray costs associated with relocation, expansion, and operation. Funding may be earmarked for impact or permit fees, or used for infrastructure, land acquisition, infrastructure development, utilities, and tax liabilities, among other costs.

Discounted REDC-Owned Land: The REDC can sell shovel-ready land at well below market rates within the Rockwall Technology Park, as well as on Justin Road.

(It should be noted that a qualified project desiring property outside of REDC-owned land will receive the same incentive value of an identical project desiring development on REDC-owned property. The REDC strives to provide no “added” financial benefit for a company choosing REDC property over a viable private property in Rockwall.)

State Incentives

Texas Enterprise Fund: The TEF is designed to attract major employers when one site in Texas is considered against viable out-of-state alternatives. These discretionary cash grants between $1,000 – $10,000 per job may be available to businesses that create at least 75 jobs. More information about the program, including how to qualify, can be found here.

Additional information on incentives and programs offered in Texas can be found here.